Some Known Details About Pvm Accounting

Some Known Details About Pvm Accounting

Blog Article

Fascination About Pvm Accounting

Table of ContentsSome Ideas on Pvm Accounting You Should KnowUnknown Facts About Pvm AccountingThe Pvm Accounting PDFsIndicators on Pvm Accounting You Should KnowThe smart Trick of Pvm Accounting That Nobody is Talking AboutAbout Pvm Accounting

Ensure that the bookkeeping procedure abides with the law. Apply required building accountancy criteria and procedures to the recording and reporting of construction activity.Understand and preserve standard expense codes in the accountancy system. Connect with numerous financing firms (i.e. Title Company, Escrow Company) concerning the pay application process and demands required for settlement. Manage lien waiver dispensation and collection - https://triberr.com/pvmaccount1ng. Display and fix financial institution concerns including fee abnormalities and check differences. Assist with executing and preserving inner monetary controls and treatments.

The above declarations are planned to explain the general nature and level of work being executed by individuals appointed to this category. They are not to be understood as an exhaustive listing of obligations, responsibilities, and skills required. Employees might be needed to do tasks outside of their normal responsibilities periodically, as needed.

Pvm Accounting for Dummies

You will assist support the Accel team to ensure distribution of effective on time, on spending plan, projects. Accel is looking for a Construction Accounting professional for the Chicago Office. The Building Accountant carries out a selection of bookkeeping, insurance coverage compliance, and job management. Functions both individually and within details departments to keep financial records and make particular that all records are kept present.

Principal responsibilities consist of, yet are not limited to, dealing with all accounting features of the business in a prompt and accurate manner and offering records and timetables to the company's certified public accountant Company in the preparation of all monetary declarations. Guarantees that all accounting procedures and functions are handled properly. Accountable for all financial records, pay-roll, banking and day-to-day operation of the audit function.

Works with Project Supervisors to prepare and publish all monthly billings. Produces monthly Work Expense to Date reports and functioning with PMs to resolve with Job Managers' spending plans for each job.

Some Ideas on Pvm Accounting You Should Know

Efficiency in Sage 300 Building And Construction and Property (previously Sage Timberline Office) and Procore building and construction monitoring software a plus. https://fliusp-dyneord-typeiasts.yolasite.com. Need to also be proficient in various other computer software program systems for the preparation of reports, spread sheets and other audit analysis that might be needed by monitoring. construction accounting. Need to have solid organizational skills and capacity to prioritize

They are the monetary custodians that guarantee that building and construction projects remain on budget plan, abide with tax policies, and preserve economic openness. Construction accountants are not just number crunchers; they are calculated companions in the construction process. Their main function is to take care of the economic facets of construction projects, guaranteeing that resources are designated effectively and economic threats are minimized.

Little Known Facts About Pvm Accounting.

They function closely with project supervisors to develop and monitor budgets, track expenses, and projection economic requirements. By keeping a tight hold on task financial resources, accounting professionals aid prevent overspending and economic troubles. Budgeting is a foundation of successful construction Resources tasks, and building and construction accountants contribute hereof. They develop in-depth budget plans that encompass all task costs, from materials and labor to authorizations and insurance.

Building and construction accountants are well-versed in these guidelines and make certain that the project conforms with all tax obligation needs. To excel in the role of a building and construction accountant, individuals require a strong academic foundation in bookkeeping and financing.

In addition, certifications such as State-licensed accountant (CPA) or Certified Building Market Financial Expert (CCIFP) are very pertained to in the sector. Functioning as an accountant in the construction industry comes with an unique set of challenges. Construction projects frequently include tight deadlines, changing policies, and unexpected costs. Accountants should adapt swiftly to these difficulties to keep the job's monetary health and wellness intact.

See This Report on Pvm Accounting

Ans: Building accountants develop and keep track of budgets, recognizing cost-saving opportunities and making certain that the job stays within budget plan. Ans: Yes, construction accounting professionals manage tax obligation compliance for building and construction projects.

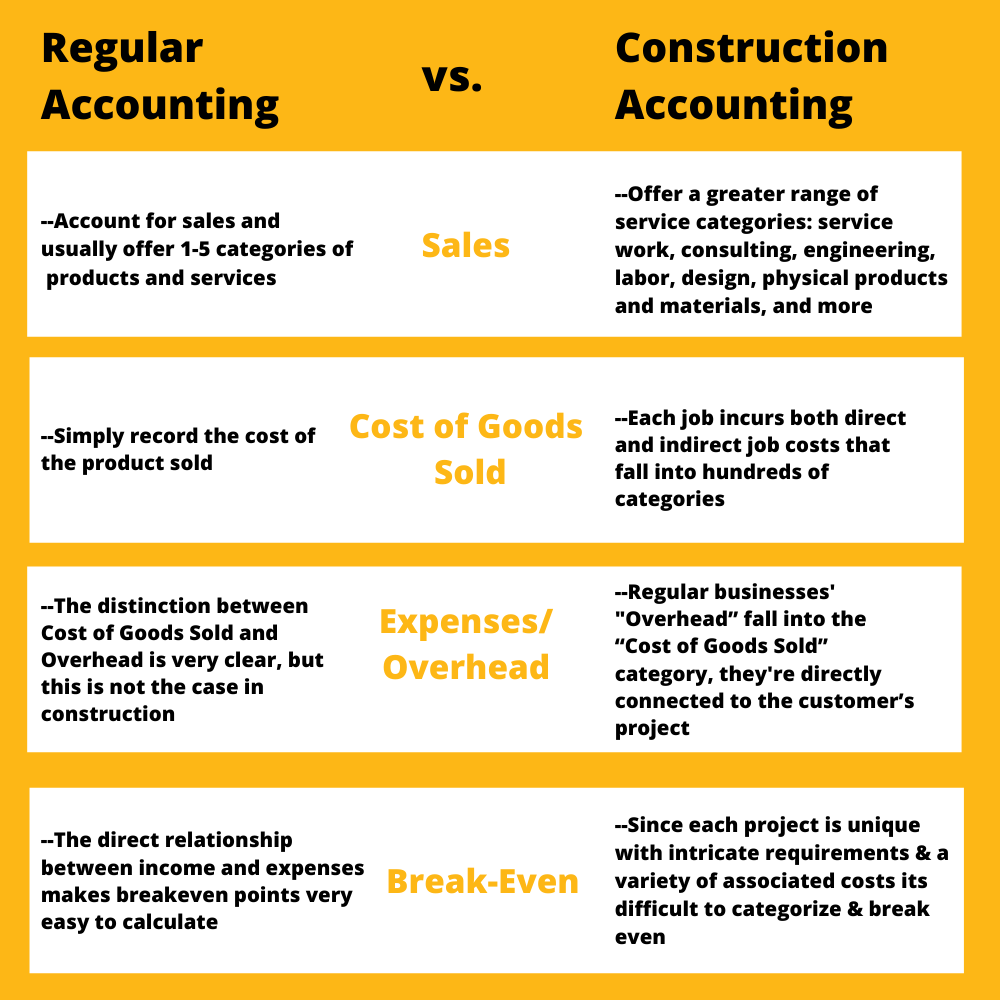

Intro to Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building companies need to make difficult options amongst lots of financial options, like bidding on one job over an additional, choosing funding for materials or devices, or setting a task's revenue margin. On top of that, building is a notoriously unstable industry with a high failure price, slow time to settlement, and inconsistent cash circulation.

Regular manufacturerConstruction service Process-based. Production entails repeated procedures with quickly identifiable expenses. Project-based. Production needs different procedures, materials, and devices with differing expenses. Repaired area. Production or production occurs in a solitary (or a number of) regulated places. Decentralized. Each project happens in a new area with varying website problems and special challenges.

4 Simple Techniques For Pvm Accounting

Durable relationships with vendors ease negotiations and enhance effectiveness. Irregular. Constant usage of various specialized contractors and providers impacts performance and capital. No retainage. Payment shows up completely or with routine repayments for the full contract amount. Retainage. Some portion of settlement might be held back up until job completion even when the professional's work is finished.

While traditional makers have the advantage of regulated environments and enhanced manufacturing processes, building companies need to constantly adapt to each brand-new project. Even rather repeatable projects require alterations due to website conditions and various other variables.

Report this page